Why you ought to Like Residential Domestic Money

If you would like cash-out your home security to invest from high-appeal personal credit card debt, add the amount of loans you are paying on loan matter, like this:

Make current mortgage harmony which you have. Today range from the credit card equilibrium that you would like in order to pay off. The fresh full is separated by your home really worth so it amount can be your LTV (loan-to-worthy of proportion)

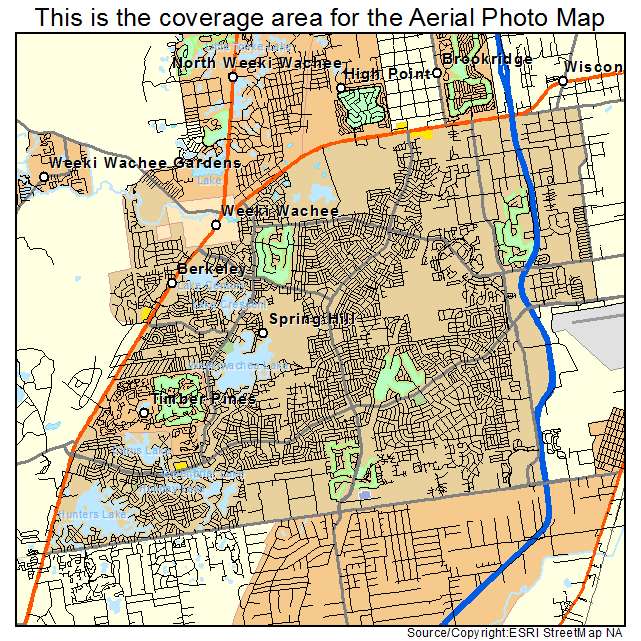

Such as for example, imagine if your existing mortgage balance was $225,000 towards the a house which is value approximately $eight hundred,000, and also you have to pay-off $15,000 inside credit card debt. Their calculation would feel like it:

Because your financing-to-worthy of proportion is actually less than 80%, it is possible to refinance and cash aside sufficient security to pay off your credit debt without having to pay getting mortgage insurance! In this analogy, it’s an intelligent monetary choice. Our registered financing officials can opinion your very own money at no pricing and help you create a knowledgeable choice that works getting you.

Combine Debt because of the Refinancing Their Home loan

It is most likely not a wise monetary choice to keep stability on highest-interest money or credit cards if you have the ability to refinance your home and you will consolidate their large-desire financial obligation on the one to low payment per month when you are purchasing less overall every month. Along with, rather than mastercard desire, the eye in your financial might be tax-deductible, however, make sure to installment loan companies in Spokane MO consult your accountant to talk about questions.

Even if you don’t have prime borrowing, we could assist! We works directly with short and you may credible borrowing resolve organizations. Paying down their higher-desire expenses smaller is also substantially improve your credit score.

Have to see if you can decrease your monthly payment or take cash-out to gain access to currency for your almost every other bills? Click here now.

Are you interested in consolidating a few mortgages? At the Residential Family Capital, we can make it easier to refinance one another funds into one that have a good competitive price that’ll somewhat lower your month-to-month mortgage payment. We’ve got aided Americans for more than 15 years straight down their monthly payment of the refinancing. Contact us today to see how we could let!

Within RHF, you’ll receive a simple, simple and fast online software techniques having reduced documentation. Permits you to log in any moment and you will song the new updates of one’s mortgage software.

Our house Financing Advantages are around for answer your inquiries big date otherwise evening, that assist you understand the facts so you have the correct individualized home loan just for you.

Prominent Mortgage Choices for Combining Personal debt

Virtual assistant loan Experts and effective army players is combine financial obligation that have a decreased fixed rate and will grab cash out to 100% of one’s property value our home!

Frequently asked questions

More often than not, you can make use of range from the closing costs with the delivering an alternate home loan toward total re-finance add up to end paying something out-of-pocket on closing. Yet not, refinancing to locate cash-out otherwise consolidate your debt could possibly get effect during the an extended financing title or a higher level, and therefore might suggest using significantly more from inside the notice full from the longer term.

Specific says provides limitations about soon or how often the people is refinance a home loan. These types of limits are often made to ensure that the refinance procedure gurus brand new homeowner. Additionally, we need to always get professional advice out of a person who can assess your financial situation and provide truthful advice. At RHF, you to individualized credit is what i would most useful.

While struggling to pay their costs and you will feel youre weighed down by the personal debt, it’s not just you. You will find countless someone else in the same motorboat. For many individuals, an intelligent, custom obligations administration consolidation system is the greatest account regaining control over their funds and you can building a solid base on upcoming.