The house lenders is actually local that’s where to help

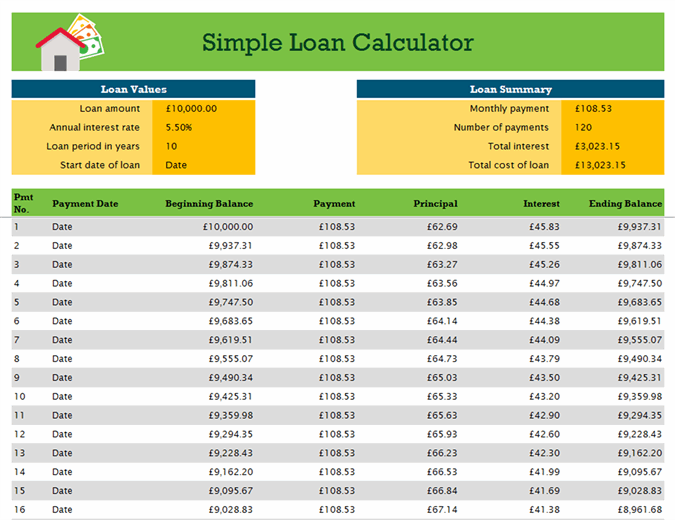

Without difficulty work-out exactly what your home loan repayments might be playing with our convenient calculator. All the we want from you is some basic details about brand new possessions and you can amount borrowed, and we’ll inform you exactly what your prospective month-to-month, fortnightly, otherwise a week costs on the financial is. You may try out different options understand just how circumstances eg rates of interest or mortgage terms can impact your loan costs.

Prepared to grab the step two to your brand new BCU Bank financial? Book a scheduled appointment with one of our knowledgeable family credit specialists over the telephone, thru videos call, or even in-individual we could also fulfill you immediately and put one to is right for you!

How can i pay-off my home loan less?

Imagine choosing home financing that offers a counterbalance account to help you make it easier to shell out the loan off smaller. A counterbalance account may help reduce the number of notice you spend in your mortgage, so a lot more of your instalments go to the concept.

You can even try to make even more repayments, sometimes since the a lump sum payment otherwise regular costs. Paying off a week or fortnightly rather than monthly may also help. With normal repayments, over the course of annually, you will end up paying some extra on the loan – and every little bit matters!

Because of the choosing the a lot more repayments’ case to the our house mortgage payment calculator, you might estimate the newest feeling one and also make most repayments will have on your mortgage.

Just how tend to while making a lot more financial costs remove my personal complete costs?

For individuals who spend more minimal month-to-month cost for the financial monthly, you’re able to spend your loan out of quicker and you may save well on attract. The actual offers depends upon items for instance the regularity and you can number of their additional money.

The house financing installment calculator enables you to observe how paying most to your house mortgage could reduce the quantity of notice you’ll shell out along the life of the loan. So when they do say, viewing is actually thinking.

Is there a penalty to possess paying down my personal mortgage very early?

For changeable speed lenders, there isn’t any penalty otherwise split cost’ percentage when you shell out your loan from very early. There is certainly some slack costs percentage to have repaired rate money and you’ll get the information on the loan offer.

How do i button my existing mortgage so you can BCU?

Our very own financing specialists work along with you to discover an educated loan loans in Trinity, or blend of finance, for the personal demands and you can make suggestions from software techniques.

If you want to speak to a home loan professional, excite e mail us toward 1300 228 228 or book a consultation on the internet.

Information

Any information about this site is actually standard in general and does perhaps not consider carefully your private needs, expectations or financial predicament. All of our pricing is actually most recent as of today and can transform on when. Borrowing from the bank eligibility criteria, fine print, charges and you will costs use.

Due to the fact there’s always specific small print

The outcome out of this calculator shall be put as the an indication just. Rates offered is actually getting illustrative motives simply and so are according to the information offered. Results differ depending on the applicant’s domestic venue. The fresh computations do not make up people device features otherwise charges and charges which is often billed into financing or charge such as Lenders Home loan Insurance rates, and therefore if the relevant could add into the cost of the loan and costs. Overall performance do not represent a quote otherwise pre degree for an excellent financing. Private institutions incorporate various other algorithms. Pointers including rates of interest cited and default data included in this new presumptions is susceptible to transform.

Analysis rate calculated on an amount borrowed out-of $150,000 more a term out-of 25 years predicated on month-to-month money. To have varying Desire Merely financing, review prices are derived from a primary step 3 seasons Attract Only several months. For fixed Notice Simply loans, research prices derive from a first Desire Just several months equivalent in total on fixed months. While in the an interest Simply months, your Focus Just payments does not decrease your financing harmony. This may suggest you pay significantly more desire across the longevity of the loan.

WARNING: So it review speed enforce only to the fresh new example or advice given. Some other number and you may terms will result in other research cost. Will cost you such redraw charge or very early fees fees, and value deals such as payment waivers, commonly included in the evaluation rate but may influence this new price of the loan.