Once you have chose a lender, gather all monetary documentation to verify you could pay back the latest HELOC

Very lenders will let you use locally off 75% so you’re able to 90% of home’s well worth, minus your debts on your no. 1 mortgage. To determine whether or not you can easily hit that endurance, you need the lower than formula, and therefore assumes a loan provider can help you borrow around 85% of your house collateral:

$five-hundred,000 [current appraised worthy of] X 0.85 [limitation security fee you might obtain] $eight hundred,000 [outstanding mortgage harmony] = $twenty-five,000 [what the financial allow you to borrow]

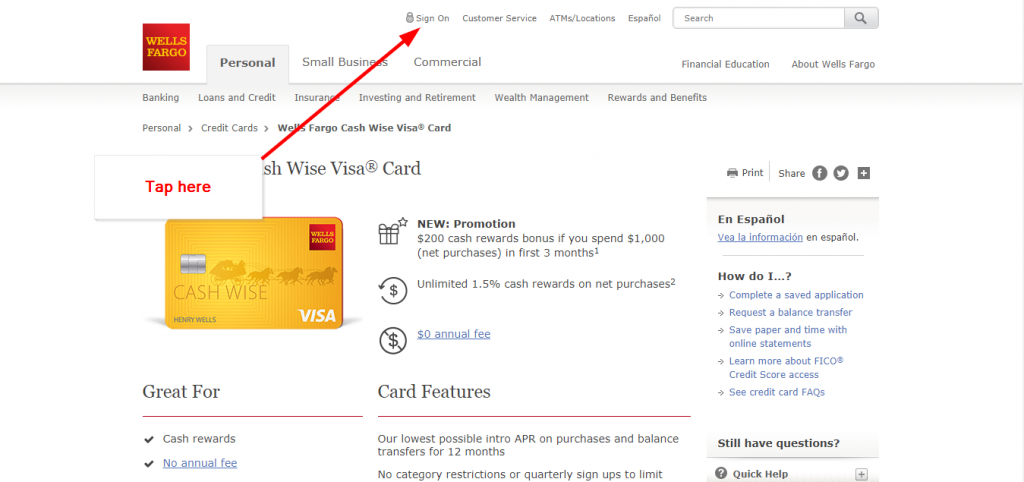

3. Reach out to loan providers

It is essential to interviews multiple lenders when you want to utilize your residence security to possess capital. The more banking institutions and you may lenders your contact, the better your chances of wanting even more positive prices and you will charge full. You could begin to the lender otherwise bank you to given your own first-mortgage, since they’ve currently acknowledged you for example mortgage and you’ve got a current relationships. You can also examine rates of on the internet loan providers.

cuatro. Send in the job

You will want proof of earnings and you can employment, and in some cases, you may have to buy another type of easy loans in Cedaredge domestic appraisal to help you gauge the economy property value your property.

Whatsoever debt files was filed, the very last action should be to personal for the financing, that may grab from around 31 so you’re able to 60 days based on the lending company.

Tricks for contrasting multiple HELOC offers

The fresh gives you located are different off bank so you can financial, but the so much more you are aware in regards to the specific intricacies of them even offers, the higher your odds of spending less and you will attention. You will find several biggest you should make sure whenever choosing which HELOC provide to choose.

Introductory rates period

Since the HELOCs have variable interest levels tied to the top rate, your own interest will go top to bottom through the years. Look for just what best rate was and you will know that you’re going to be spending good markup thereon interest rate.

Initially, most HELOCs have a lowered basic rates months, although amount of those people first rates usually differ from the bank, and you also want to discover longest that you can. The latest prolonged you have less rate of interest, more currency it can save you over time. There are also specific lenders which enables you to develop your rate of interest to possess the main loan, which offers a very foreseeable fee.

Rate cover

Inquire about your restrict HELOC rate of interest limit. HELOCs keeps life interest rate limits, very even when the primary speed goes up and is preferable to their rates limit, your own HELOC speed wouldn’t raise any further. For those who have an existing HELOC, you can look at in order to discuss a diminished rates together with your bank.

Ask your newest HELOC bank whenever they usually enhance the interest rates on your a good balance, said Greg McBride, head economic expert in the Bankrate, CNET’s cousin webpages. Particular lenders bring this, of many dont. However it is worthy of asking the question.

Minimum withdrawals

Certain lenders wanted minimum distributions despite the overall distinct borrowing. You won’t want to get trapped and work out interest payments with the funds you don’t actually need if it amount is less than the latest compulsory minimal withdrawal number put by your financial. You’ll want to learn should your draw period finishes thus you can afford the bigger dominant-plus-attention money once you go into your cost months.

Solutions to a HELOC

- Household equity money is actually a different house equity financing. Having a house collateral loan, you are taking aside a-one-big date loan that have a set count, financing identity and interest rate, up coming pay it back in monthly premiums. A house collateral loan performs such a personal bank loan but it is actually protected by the household, just like a HELOC.