How do you Determine if It’s a lot of fun to Re-finance?

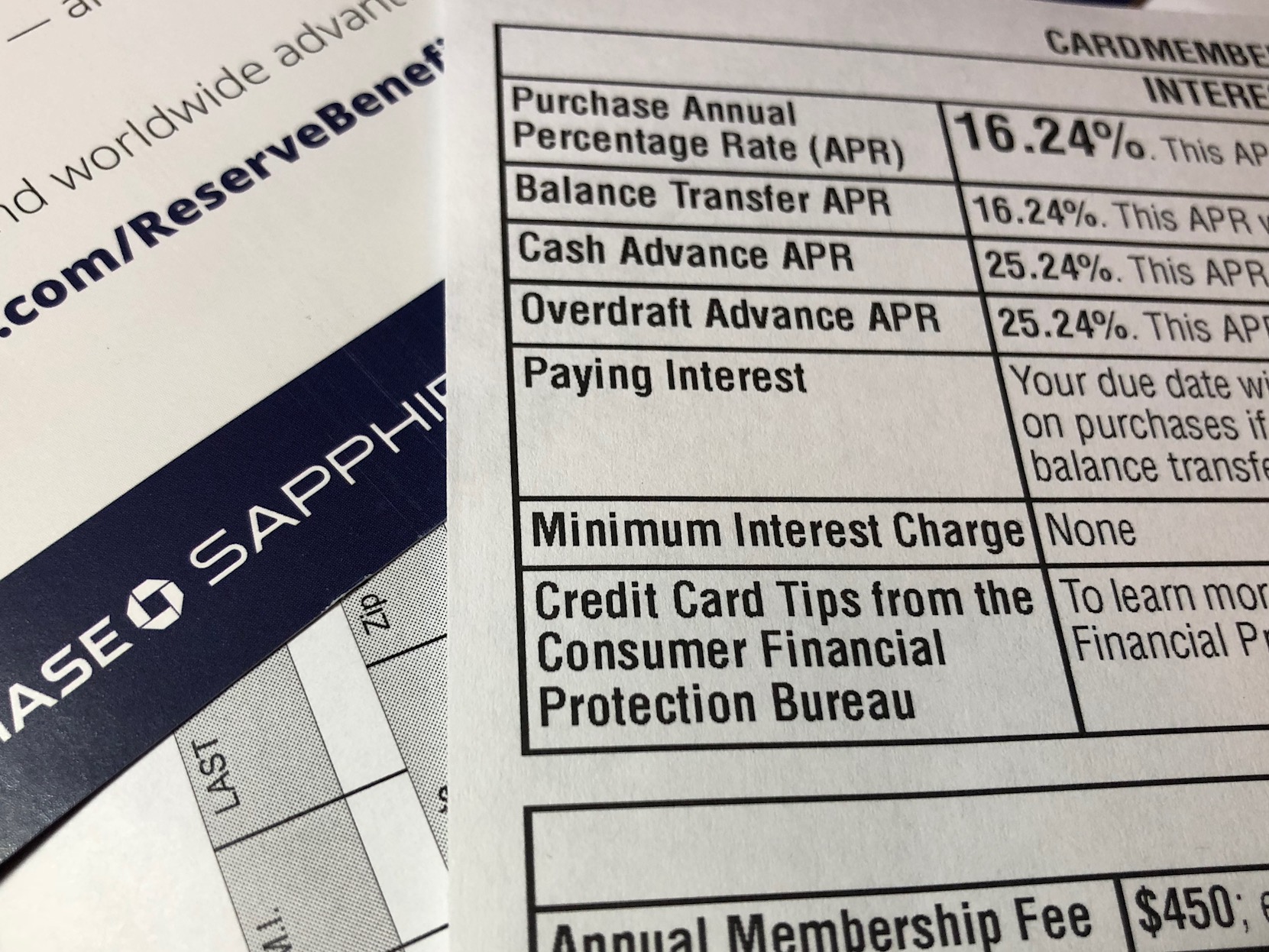

step one. Down Interest

One of the most well-known reasons to re-finance should be to safe a lower rate of interest. Through the a 30-12 months financing, you might end using quite a bit of desire. Lowering your rate will save you a lot of money more than the life of the loan.

Caution: You will find right up-top expenses associated with refinancing. To make sure that your new interest discounts will provide more benefits than these will set you back through the years, a lender does some elementary computations to see if refinancing shall be a good idea to you. Certain believe that you should conserve at least step 1% on the interest to own a beneficial refinance and work out experience, but that’s not at all times the way it is.

Your own coupons will depend significantly with the measurements of the loan youre refinancing. For example, a good ?% interest rate cures towards a $eight hundred,000 re-finance will save you more income total than a 1% interest rate reduction on an effective $fifty,000 refinance. Let your bank make it easier to assess the savings.

dos. Lower Monthly obligations

Once you decrease your interest rate instead modifying the length of the loan, you will be cutting your monthly payment. Fundamentally, you are taking aside a special 30-year loan. Since your principal is leaner immediately after numerous years of paying your fresh mortgage, your monthly payments drop off.

Instance, anyone with a great $100,000 loan at the 5% attract would shell out throughout the $537 per month to possess thirty years.

If you would like free up a few of funds for every week to invest towards the whatever else, this type of refinancing might be the correct choice for you.

3. Shorten The loan Term

One good way to refinance the loan is to try to trade-in your 30-year loan to have good fifteen-12 months home loan. 15-12 months funds often have down rates. Yet not, the fresh new tradeoff is frequently higher monthly obligations.

You might also do a faux re-finance by making even more money to the the 30-12 months financing so that you pay it back in two the latest date. You’d save money upfront as you would not need to pay the newest label payday loans Astor, insurance coverage, or closure fees so you’re able to refinance. It also will provide you with the flexibleness to lessen their monthly obligations in case your financial situation changes in the long term. This is an excellent alternative in the event that refinancing wouldn’t allow you to get a reduced adequate interest rate so you can offset the upfront costs.

cuatro. Change your Loan Style of

Finance have sometimes a varying interest otherwise a fixed rate. Many people choose to re-finance to evolve the sort of rate they own. In the event the interest rates is actually reduced, it would be best if you refinance your changeable-rates financing so you’re able to a predetermined-rate mortgage to lock in one lower rate of interest.

Usually, interest rates commonly increase once more as time passes, thus securing a favorable fixed-speed financing will save you a large amount of money more than big date.

Downsides out of Refinancing

Refinancing actually constantly the best decision. For just one, it can be most day-taking since you glance at the whole loan procedure all-over again.

You also have to pay all loan charges once more, plus title and you will home loan tax. The most significant debts is actually spending closing costs once again.

If you decide to re-finance your own 29-seasons home loan with an alternate 30-year mortgage, a few your the rate of interest is much less than your current speed. If it’s merely slightly best, you can actually end expenses far more when you look at the appeal over time.

Your financial situation nowadays might make it essential you to lessen your payment per month. not, you should put a whole lot more towards the your prominent afterwards if you could potentially to minimize your own total attract payments.

You have a premier-rate of interest financing should you have in order to seek bankruptcy relief, recorded to own divorce proceedings, otherwise had a financial crisis. Lenders bring most useful rates to those which have high credit scores, so you may have to refinance since your credit history bounces straight back.

Refinancing ount from security of your home while need to borrow against it to possess family renovations. You will get bucks to cover the newest standing and lower your own rate of interest meanwhile.

Keep in mind that refinancing usually will set you back step 3% – 6% of current loan’s dominating harmony. It takes a few years to suit your appeal savings in order to recoup one first costs. If you were to think you’ll offer your home in the future, you do not have time to recuperate men and women upfront will set you back. If so, it may not feel smart to re-finance.

Most of the Disease is exclusive

You can even initiate their refinancing choice which have an easy mortgage calculator. When it looks like refinancing could be sensible for your, get in touch with our very own mortgage specialist. We could make it easier to have a look at your own refinance desires and you can perform some 1st earliest calculations in the place of asking people fees or draw borrowing from the bank.

Our very own initially data assist see whether or perhaps not the potential coupons was significant sufficient about how to go through the refinance procedure. Which have a low day partnership beforehand, to each other, we could choose which refinancing chance, if any, is the best for your.