Cannot Strike They Once You may be Pre-Recognized For the Home loan

Bringing pre-recognized for your financial is a big initial step. It’s fundamentally letting you know that you can pay for a house. Its a nuclear bomb in your collection and lets sellers and you will agents know that you are serious. But not, this is simply not the end of your financial documents, and you may doesn’t mean that you have that which you safe. There are still a great amount of hurdles to get over. Listed below are 8 things to bear in mind where several months between pre-acceptance and finalizing the past documents

Keep your Automobile Until you Move around in

Here’s a term that you will tune in to Much throughout this post. DEBT-TO-Income Ratio. This really is probably one of the most techniques to store from inside the mind inside entire process away from trying to get your property. Make sure that you try not to add more debt from what your currently have, otherwise they trigger warning flag from inside the processes. We’ll work at their borrowing from the bank via your software, but we will and view once again before we accept, in order that little drastic has taken place. If you purchase a different automobile and you will put a lot of obligations for your requirements, it can skew their borrowing from the bank and you will force me to need certainly to to change the borrowed funds. Wait until when you to remain the fresh dotted line, men.

Cannot Start That Brand new Business Yet ,

Something that mortgage organizations such as for example you prefer to look for try Balances. You want to remember that you are invest your job and you can aren’t probably move around, given that we need one pay back the home loan. Certainty on your own updates is a huge factor in their financial, and in case you abruptly option work, or start a unique providers, your capital circumstances changes, and now we need to readjust the job to match it. This may end in their interest rates to evolve while the rely on inside your ability to settle your loan could possibly get decrease.

Continue That Regular Paycheck

This is certainly an identical cause. Whether or not you are going to earn more money right away, an alternate, heavily-accredited employment frightens financial businesses. Supposed regarding an ensured paycheck to at least one where you can create wildly some other number on a monthly basis try a play, rather than one that home loan people want to get sprung to your them shortly after they’ve got currently viewed your steady paycheck.

Allow your Money Settle

Let your currency accept. Banks and you may financial businesses https://paydayloanalabama.com/leroy/ do not like observe your money moving around once we approve you having a mortgage. It will not promote faith to see several thousand dollars gone around. The lender will also possibly verify your hard earned money reserves to be certain as you are able to spend the money for settlement costs with the mortgage so keep your money in which it is.

Keep Debts Latest

Even although you is disputing a costs, pay it if it’s planning getting a later part of the payment or other hit up against their borrowing from the bank. These are borrowing poison, and we’ll see them as soon as we would all of our view before final acceptance of your own mortgage. Their financial was a continuously altering matter that really must be tracked. Don’t allow an adverse costs help keep you out of your fantasy house!

We become it. You will be moving into your new family therefore want everything willing to move around in. Don’t get it done! In the event you’re going to get the best package actually by filling out a credit card to buy your furniture and you may devices, alot more financial obligation is more personal debt! You really need to keep the Loans so you’re able to Income Ratio due to the fact reasonable as you are able to about app procedure. If it alter appreciably we have to reassess your credit score also it can connect with a final application.

Fill out Your own Gift Documentation

Many parents offer a present on the college students to make their first advance payment on the belongings. Yet not, this might be an asset that has to be signed and you may taxed properly. Discover other statutes for how the newest off repayments for each style of loan may be used.

Antique

- For individuals who lay out 20% or even more, it will all be off a gift.

- For individuals who set-out lower than 20%, area of the currency should be something special, however, area must are from the money. So it lowest share may vary of the financing type of.

FHA and you may Va

If your credit score is actually ranging from 580 and you can 619, at least 3.5% of your advance payment have to be their money.

You also will need this new gifter to transmit something special Letter a letter explaining that the cash is a gift and never that loan. You truly need to have these to become:

- The fresh new donor’s label, target and you will phone number

- The fresh new donor’s link to the client

- The brand new money quantity of the present

- The latest big date the funds was in fact directed

- A statement in the donor you to no payment is expected

- The donor’s trademark

- The newest address of the house are ordered

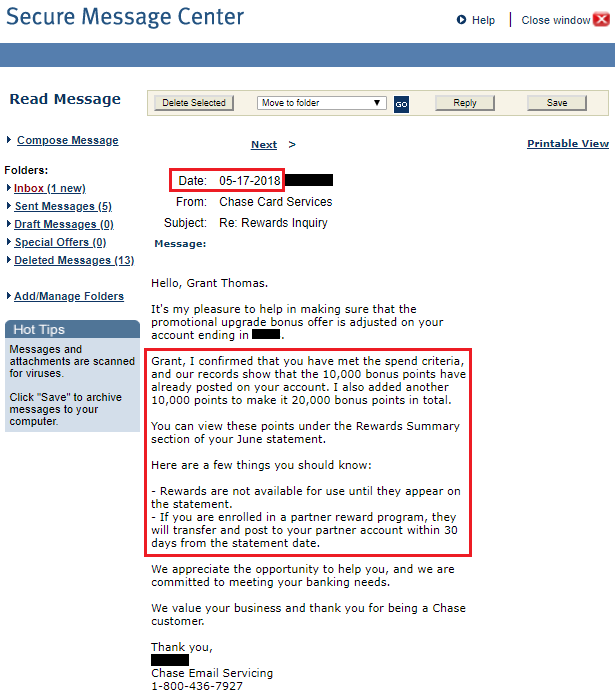

Mortgage organizations want to know in which your bank account is inspired by, so that they know if you have got any expenses that will perhaps not appear on your credit report.

Remain Paperwork When it comes to Places

In the event you get any money you need to guarantee that that it is reported carefully. For many who offer your car, receive an inheritance, or victory the latest lottery, that’s great! not, it must be reported securely. For people who promote a car or truck, needed at the very least brand new declaration regarding profit. Having the ad your accustomed sell and also the Kelly Blue Publication showing the value try not to harm, both. For those who acquired a payment out of a vintage debt, the latest cancelled look at tends to be adequate, or a page throughout the payer may be needed. In case your organization doesn’t do lead deposit, be prepared to inform you have a look at stubs for your paychecks. The thing that makes that it essential? Because your bank desires discover definitely what those funds is. In case it is that loan, they will find out. Just be honest, because hiding financing from the financial try ripoff.