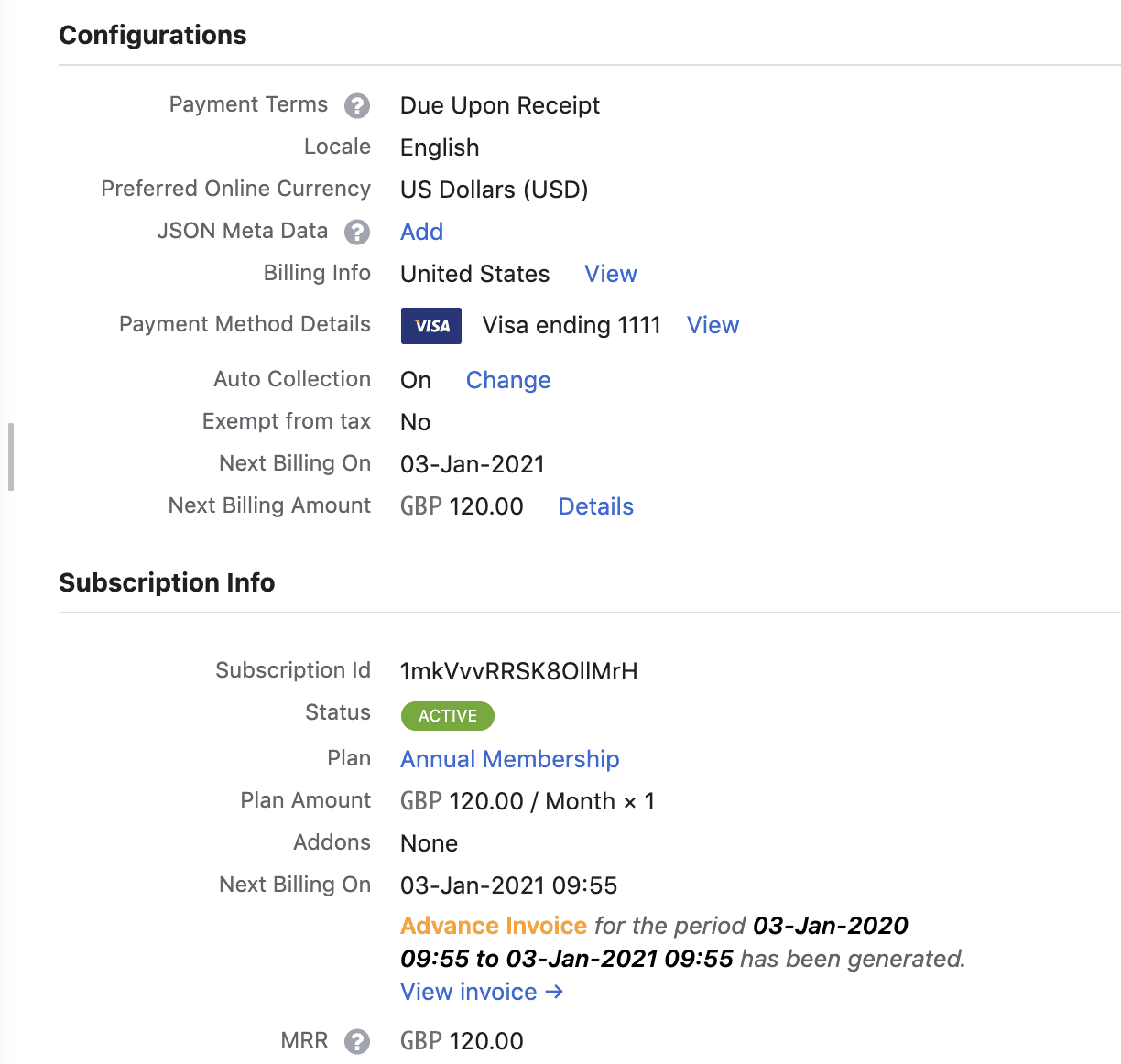

After you have the borrowed funds, it functions due to the fact a continuing arrangement along with your lender

- Household cost have dipped from its level at the outset of 2024. According to National Connection out of Real estate professionals (NAR)’s the reason Affordability List Statement, the fresh new value directory has arrived down seriously to 95.9, level out of 105.7. Also that high section is actually notably lower than 2021’s affordability directory of 148.dos. (National Relationship off Real estate professionals)

- Simply 19% off consumers faith its already a lot of fun to buy a beneficial home. That being said, this display shows an uptick out of 14% during the . (Federal national mortgage association)

- Client satisfaction having mortgage brokers is at a practically all-date highest. Considering analysis regarding J.D. Energy, full customer happiness that have lenders is at 730 from 1000 when you look at the 2023, upwards fourteen things on seasons previous. (J.D. Power)

Just how can Mortgages Performs?

Each month, the initial amount away from what you pay goes toward one interest that’s accrued since your last fee. Whatever’s left-over visits paying down the loan balance (exactly what lenders label principal).

- When you have a predetermined-speed home loan, extent you can easily shell out per month on prominent and you may attention never transform.

- For those who have an adjustable-price financial (ARM), their payment per month can move up or off. This transform goes at the menstruation discussed on your financing, constantly twice yearly otherwise annually. If the fee increases otherwise off relies on the brand new index that their mortgage are tied. A great amount of loan providers use the Shielded Right-away Financial support Rate (SOFR), for example.

- When you yourself have a crossbreed Case, the payment stays fixed on basic section of your own mortgage (always, 5 to eight age). Next, they changes to help you a variable-rates mortgage, together with your price modifications future given that revealed on your financing terms and conditions.

No matter which kind of mortgage you’ve got, your property serves as guarantee. This means that for many who end and make your home loan repayments to have sometime, the bank is grab our house.

Kind of Mortgage loans

An informed home loan people usually give a number of different varieties of mortgage loans. So you can browse your alternatives, we are going to leave you a quick review of the most used groups regarding home loan finance:

Compliant funds

Annually, the Government Houses Fund Agency (FHFA) lays out a limit to own financing amounts. Such vary according to where you live, that have high-cost elements getting high ceilings. For many of the country, in americash loans Milliken the event, new FHFA restrict having 2024 was $766,550 to own an individual-family home.

Should you get a home loan this isn’t more your area’s FHFA restrict, it is named a compliant mortgage. Certain authorities-recognized money is compliant funds. But if your financing does not have any federal backing, it is titled a conventional compliant financing.

Nonconforming financing

If you would like discuss this new FHFA’s limit or require to act more strange-instance get an interest-simply financing-the financial will be non-conforming. Mortgage loan loan providers basically evaluate these money highest-exposure, thus you are able to constantly pay a great deal more in attract for those who wade this station.

Government-recognized loans

Specific government firms promote to stand trailing finance. If your borrower stops make payment on financial straight back, that department can assist the lender recoup a few of the will cost you. It put up reduces the chance for mortgage companies, thus regulators-backed funds incorporate perks including straight down interest levels and much more everyday borrowing from the bank requirements.

- Va funds. The fresh new Service from Experts Factors (VA) backs this type of finance to possess active-obligations army professionals and you may veterans which fulfill at least service requirements. Virtual assistant money don’t need one downpayment.

- FHA money. New Federal Housing Management (FHA) supports these funds to assist consumers just who you will otherwise feel incapable of rating resource. You could possibly be eligible for a keen FHA mortgage with a cards get as little as 500 as much as possible lay 10% off.